Abstract

- The AVA Hedging Coin is a hybrid ERC-20 protocol that takes advantage of both distributed and centralized features of existing stable coin solutions and explicitly addresses the known drawbacks including scalability, trust and run issues.

- The AVA has a built in solution to the insidious problem of blockchain scalability. The scalability comes from a transparent choice of either a fully blockchain-based solution, if so desired, or outsourcing some or most of the work off blockchain with an audit trail — a concept similar in spirit to the Lightning network. The AVA protocol is blockchain agnostic, with initial development on Ethereum.

- At its core, AVA creates a distributed intelligent trading system based on blockchain technology. It implements a novel concept of self-executing market order and auction-based order matching. AVA trading technology adopts and rethinks best ideas in finance in service of hedging your exposure in volatile conditions of crypto-markets.

- The existing solutions create vast pools of point failure inherent in fiat-backed or commodity-based cryptocurrencies. Our AVA solution distributes risk among bilateral transactions. There is no free lunch with stable coin: the only way to reduce risk is to distribute it.

- The stable coin is only one, albeit the most recognizable, application of the AVA protocol. The AVA protocol is designed to accept any external index, not just the price of ETH in USD, as the objective function in the hedging algorithm. That includes, for example, stock indices, commodities or bond prices. That opens a clear path to extend AVA to other financial products as blockchains continue to evolve.

Introduction

The first goal of AVA protocol is to preserve value of the portfolio against the USD using dynamic hedging — essentially achieving the goal of stable coin — for a specified period of time and within selected ranges of market moves. The same mechanism can be extended to maintaining the value equal to other currencies, commodities or financial indices.

Hedging is a mechanism in finance to reduce the impact of adverse price moves. When the price of cryptocurrencies rises, hedging is not on the radar screen of investors. It is when cryptocurrencies experience large price drops, hedging becomes vital. In addition, such price volatility all but rules out the use of cryptocurrencies in large commercial transactions that depend on the stability of the exchange rate between the crypto and the USD or other fiat.

During large price drops, the ability to sell your positions or buy hedging instruments is also impaired and cannot be relied on. AVA protocol solves this liquidity problem via decentralized marketplace by implementing order matching in the protocol itself. The auction mechanism of collecting and matching orders generates pools of liquidity. The inevitable scalability bottlenecks are addressed from the get-go by aggregation of orders. For the initial “bootstrap” period, and to achieve scalability in the future, the AVA protocol allows moving some or all parts of the transactions off the blockchain.

Centralized exchanges are often targets of fraud and hacking attacks. AVA protocol, in the spirit of blockchain, makes such attacks expensive for the perpetrator and non fatal for investors as the reward for hacking a single contract or even a single iteration of the auction is relatively small compared to the collateral trusted to the centralized exchanges.

A key concept for hedging is ability to liquidate a portion or the entirety of your portfolio in a timely and reliable manner, before adverse movement in price of underlying cryptocurrency erodes the hard earned profits. Our solution is to encapsulate functions of exchanges, such as liquidity provision, price discovery, credit checks and so on into smart contracts. Ethereum platform offers a convenient medium for running such exchanges, however, AVA can be readily ported to other platforms that support smart contracts. The is because the protocol allows to dynamically shift parts of the execution off the blockchain and eventually to alternative blockchains without massive upgrades or forks.

Hedging is only one part of the AVA protocol — after all “speculators” have to be on the opposite side of the “hedgers” in the contract for the market to balance. In a universal way, AVA allows investors to take short or long positions against other cryptocurrencies, but also against any other financial index, such as fiat currencies or a stock prices, provided by agreed upon trusted oracle. Leverage is directly embedded in the AVA protocol achieving the security of collateralized smart contracts without tying up large capital.

Limitations of blockchain technology such as low transaction volumes and slow execution, lack of secure connection to the outside world and chicken-and-egg liquidity problems are addressed head on at the protocol level. Similar to an “app store” the protocol is open to third-party development and will benefit from future breakthroughs in blockchain technologies.

The problem we solve

With AVA as stable coin we address several problems

- Maintaining the value of the portfolio — similar to the theoretical stable coin — over a period of time and for specified price range.

- Both hedging against adverse price movements as well as taking leveraged speculative positions in any of financial indices.

- Ease, flexibility and timeliness of transaction. AVA protocol pioneers self executing smart contract with matching and periodic auctions and eliminates the need in centralized cryptocurrency exchanges.

The native blockchain implementation is a key part of any stable coin:

The rise of the market capitalization of numerous cryptocurrencies in a space of a few months and subsequent crash revealed the key missing element need to move beyond the speculative phase of the blockchain: the value-hedging solution native to the blockchain platform. The market cap was over $800bn at the peak in late 2017 and dropped to (the still large) $120bn in January 2019.

Without the critical mass of resources in Ethereum and similar smart contract oriented blockchains prior to the increase in the market cap, past development has been directed at projects that are unlikely to address the issue of volatility and protection of the large financial resources on blockchains.

- The private distributed ledger platforms, with Hyperledger as a prime example. They utilize alternative blockchain algorithms such as PBFT to arrive at the blockchain consensus, a key innovation of bitcoin. These platforms aim to improve on the perceived deficiencies of the proof-of-work algorithm by trading in transparency and security of public blockchain for speed and central administration. Decentralized ledger architecture will likely find uses in financial application, but it is a case of “throwing the baby with the bathwater”. There is an inherent tradeoff of speed vs. security, openness vs. retaining secrecy and control. The private institutions that control the ledger is the key point of vulnerability.

- Using blockchain as a smart contract infrastructure for the physical world. The most visible example is cryptocurrency exchanges such as Coinbase that allow one to buy and sell coin for fiat currencies. These exchanges are no doubt here to stay and serve an important purpose to seed the blockchain with information and capital. Moreover, connectors to the outside world — the oracles — are an important and growing business and a key ingredient in our protocol. Nevertheless, there is an inherent limitation of the blockchain technology — low speed and transparency — that makes interface between blockchain-real and world systems prone to frontrunning, manipulation and other failures. That is the reason that these approaches have had limited traction — an example is the discontinued Velocity initiative, which attempted to implement financial derivative contracts on Ethereum. The native blockchain market price will surely include a thriving market for the oracles, which we will encourage with the AVA protocol. However, as crypto-currency marketplace grows, native solutions are likely to play more important role.

- Shortcuts of the market price discovery. There is no alternative to a fully fledged markets that facilitate price discovery. The idea such as autonomous exchange tokens, popularized first by Bancor, suffer from speculative attacks that result in inevitable collapse of the system as we illustrate in the next section. At a fundamental level, one cannot easily do away with markets that perform the price discovery. The detailed structure of the market, suitable for the blockchain, will evolve as competing ideas are tried out. Whether it is a DEX (decentralized exchange), periodic auctions or other structures, they will be easily accommodated in AVA protocol.

- Stable coin. Centralized entities such as coin exchanges or tokens backed by real-world fiat and other assets (the dollar-backed Tether is the prime example) suffer from multiple drawbacks and are unlikely to provide a lasting solution. They are prone to attack on the collateral from individuals and jurisdictions, and convertibility is an unacceptable point of failure for any economically sizable transactions. Collateral based on cryptocurrency suffers, in addition to convertibility risk, the correlation problem as cryptocurrency portfolios provide only modest diversification to any one coin.

The AVA protocol

To summarize, the two recent popular strategies to create a stable coin are :

- Centralized — stable coins fully or partially backed by fiat currencies or commodities

- Decentralized — backed by other cryptocurrencies either directly or by some stabilization algorithm.

Centralized solutions to the stable coin problem are clearly feasible if implemented by central banks or other highly credible organizations. At the same time, this solution requires regulatory buy in, and willingness to maintain the stock of the stable coins and absorb likely financial losses in an event of a run on cryptocurrencies. The recent problems with Tether show that loss of confidence in the issuing authority is the achilles heel of the centralized solution.

Decentralized stable coin solutions, however, need to overcome a significant conceptual hurdle — they are inherently unstable if demand for cryptocurrencies falls rapidly reducing the value of the collateral behind the stable coin. All cryptocurrency prices are highly correlated, and the value of the collateral falls exactly when demand for stable coin should be high. In the limiting case that value of all cryptocurrencies drops to zero, the dollar value of stable coin cannot be sustained.

The algorithmic solutions, which are centered around the idea of managing the supply of stable coins, are doubly unstable as the collateral is the same as the coin, so their values are truly 100% correlated. The value of the algorithmic stable coin (such as Basis proposal) is maintained by shrinking supply of coins in response to decrease in demand. However, demand for any cryptocurrency cannot be controlled, and periods of collapse in demand lead to the inevitable unravelling of the the algorithmic stable coin. The collapse in “money demand” is a known scourge of fixed exchange rate systemsthroughout history, with most of such systems blowing up spectacularly.

The AVA stable coin explicitly addresses these problems without hidden elements or unspecifiend liquidity pools. AVA

- Generates the transfer of risk from the buyer of the coin to the hedging counterparty.

- Separates hedging cryptocurrency volatility and the tail risk of very large drawdowns. This short-circuits the “runs” on the coin.

- Allows both centralized and distributed implementation. The goal is to establish a distributed hedging marketplace via auction mechanism described below. However, flexibility of a single counterparty would help to “bootstrap” the coin trading in the initial stage. In addition, such flexibility is likely to be invaluable in the rapidly changing crypto landscape.

- Addresses the “scalability” problem of public blockchains (slow transaction rates and high prices) by allowing the full spectrum of security from 100% distributed on-chain transactions to a high degree of aggregation of small transactions by third parties.

- Stable AVA is pegged to the USD. However, it can follow any other index available via Oracles on the blockchain without any changes to the protocol. E.g. it can follow the USD value of S&P index.

Examples:

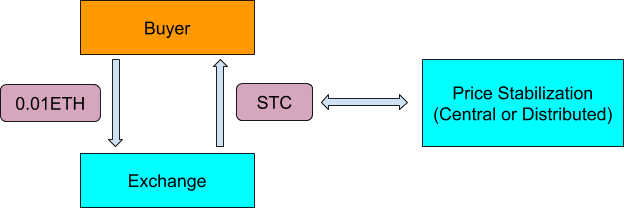

First, let’s look at a traditional stable coin transaction.

The diagram shows the purchase of a generic stable coin (STC) for 0.01 Ether (we assume for the illustrative purposes that Ether price = $100), and the stable coins represents $1 value. The complexity of the transaction is hidden in the “Price Stabilization” box.

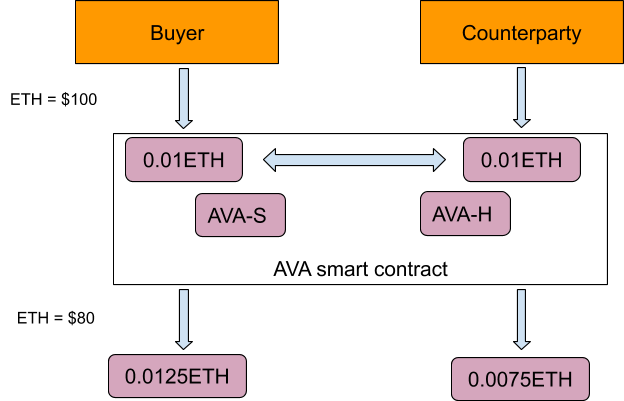

The basic AVA stable coin transaction, implemented via the marketplace, involves additional steps that show the underlying mechanism of price stabilization:

In this example, both the buyer of the stable coin (AVAS) and the hedging counterparty deposit 0.01ETH or $1 collateral and enter into the time-limited contract. The contract transfers Ether collateral from one party to the other in order to maintain the value of the AVAS at $1. The hedge counterparty value AVAH will depend on the price of Ether in dollars at the expiration of the contract, for example one week. Without taking into account transaction costs (gas) the transfer amounts are expressed by simple formulas: — below E0 is the price of 1 ETH in USD in the beginning of the hedge, E at the end of the hedge, and AVAS and AVAH are prices of AVA coins in USD. The price of AVAS is maintained at $1 via the following identity:

AVAS=1=E/E = E(1/E0+(1/E-1/E0)),

where the expression (1/E-1/E0)represents the transfer of Ether from the counterparty if E < E0that is the price of Ether went down, and to the counterparty if the Ether price went up. For example, if ether price went from 100 to 80, then the transfer will be equal to 1/80–1/100 = 0.0025 ETH. Together with the original deposit of 0.01Ether, this will be 0.0125 Ether with the value of $1 at the price of $80 for Ether, as desired.

The price of the hedge coin AVAH, given the value transfer, will therefore be equal to:

AVAH=E(1/E0-(1/E-1/E0)) =2 E/E0 -1.

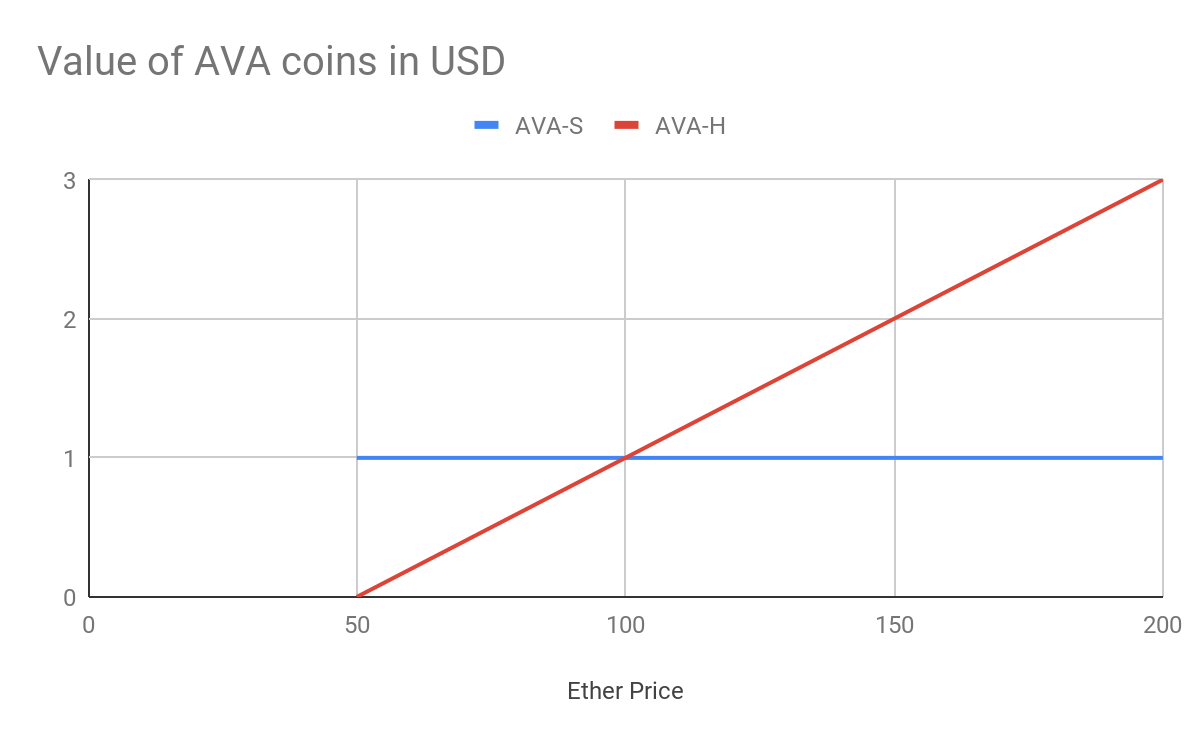

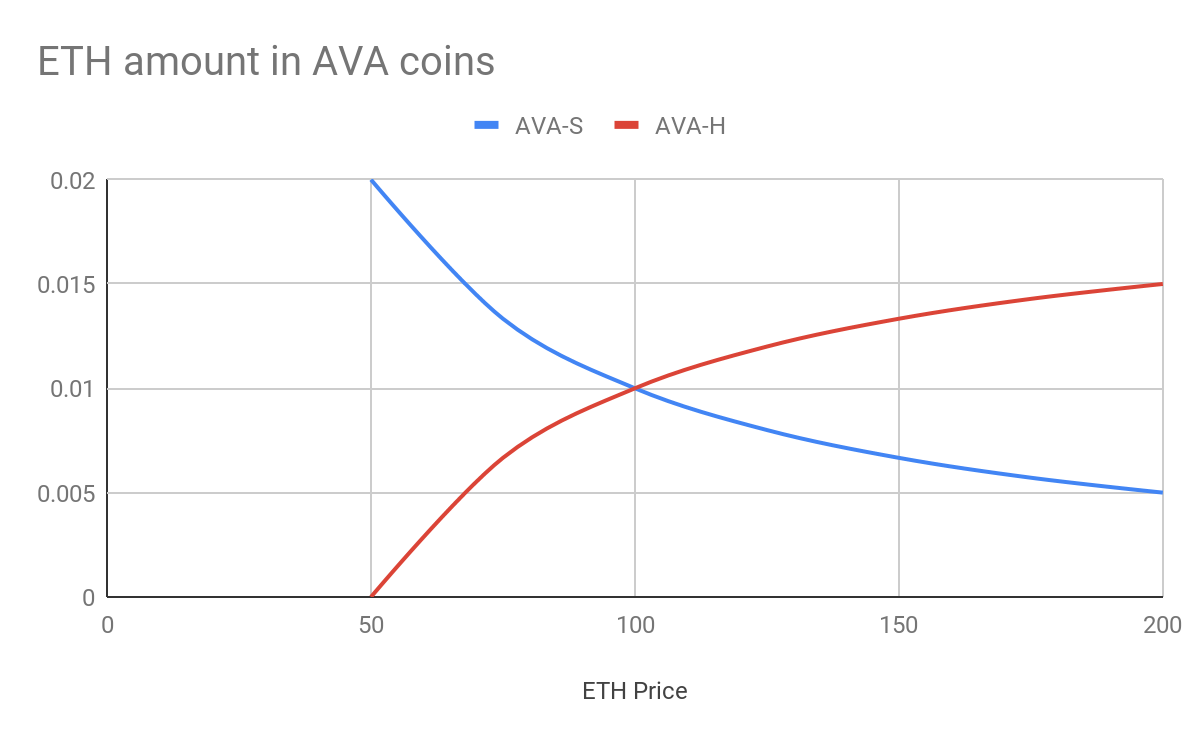

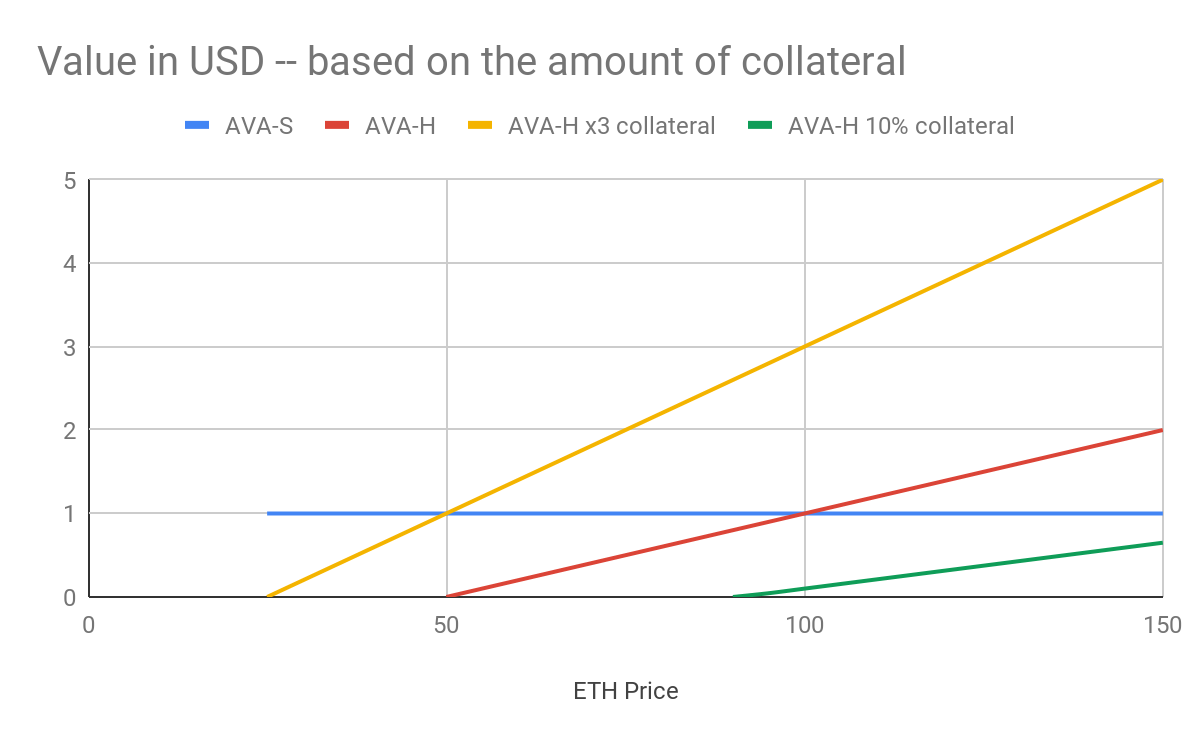

The chart shows the value of the stable and hedge AVA coins for a range of possible Ether prices and the next chart demonstrates how the 2 ETH collateral is split between the coins.

The important limitation of this algorithm is that the total value of the collateral in ETH remains the same, 2ETH ignoring cost of gas, and the hedge will work up to the price of ETH equal to half of the initial price. In our numerical example up to 50, when all the 2ETH collateral will be transferred to the stable coin. Note, that an increase in the price of Ether will not create any limitations to the hedging strategy.

Therefore, the contract, as written, will allow hedging of up to 50% price drop. However, this threshold can be readily increased by overcollateralization of the AVAH. For example, instead of depositing $1 (or ETH0.01), the hedge coin can deposit the equivalent of N dollars. A simple calculation shows that this will move the maximum allowed drop of Ether price to 1/(N+1) -1 . With N=3, this will be 75% price drop.

Likewise, the contract could be under-collateralized if the hedging collateral is less than $1. For example. If only 10% of the $1, or $0.1 is deposited, then N = 1/10, and the maximum hedge drop of the price will be 10/11–1 = -9.1%. The under collateralization of the AVAHis valuable for the counterparty as it limits its maximum loss and allows to leverage available collateral for speculators.

It is clear, however, that with any amount of collateral, there is always the price drop of ETH large enough to render the hedging strategy ineffective. This is a fundamental problem of the decentralized stable coins as they inevitably break down as price of ETH or other collateral coins approaches 0. We believe that the only sustainable solution to the problem is to be explicit about the ranges of the price fluctuation that the stable coin can sustain.

Large price moves will reduce the effectiveness of any given AVA hedge, but it doesn’t undermine the integrity of the AVA protocol because future contracts are independent of what happened to old contracts and will start with the new lower Ether prices. In contrast, a stable coin with a fixed pool of collateral (e.g. specified at the time of the issuance of the coin), will lose its link to $1 (break the buck), and collapse for sufficiently large price moves. In our opinion, such risk will prevent these strategies from taking off in the first place.

Handling tail risk of very large price drops

The solution to the tail risk problem with decentralized stable coin is a hybrid system. The AVA coin will provide protection against price fluctuation up to a maximum, while insurance for tail risk can be obtained from a centralized entity if such need arises. The main requirement for such a backstop is that it is not correlated with the crypto price (e.g. based on fiat, commodity or simply general credit of the sponsor).

A hybrid system is the most likely to succeed given enormous price volatility of cryptocurrencies and the huge uncertainty of how any particular strategy will perform over time. We already discussed fundamental “correlation” problem with decentralized stable coin. Another clear problem is scalability given the limited bandwidth of major block-chains, which we will tackle by allowing for off-blockchain aggregators in the AVA protocol. This will allow to seamlessly switch from mostly on-blockchain smart contracts for important transactions to mostly off-blockchain third party solutions (which are fully auditable using hashing techniques).

Even though our goal is to create a functioning marketplace for AVA coins as described below, the bootstrapping such market is not a given. We envision the possibility that AVA-H hedge contracts, and the insurance, will be provided initially by a sponsor (or a sponsor pool).

One of the thorny issues with market-based solutions to stable coin is when the market doesn’t exist or is very thin. To move the AVA process off the ground, we envision a bootstrap stage when a single counterparty will provide liquidity for the AVA contracts. The seeding of the AVA mechanism can be backed by a collateral pool (e.g ETH or fiat currencies), or commitment by a financial backer to facilitate transactions at the first stage of the rollout.

AVA coin

AVA is a new class of cryptocurrency that combines elements of a traditional coin with additional attributes of a portfolio and a market order. Two or more coins are merged into a smart contract as the result of order execution by the matching engine for a specified period of time, e.g. one week. The contract re-allocates the value of the portfolio between the coins according the to AVA protocol and either terminates at expiration of if one of the coins exceed the specified maximum value transfer. There AVA is:

- A coin in its own right. As with Ether or Bitcoin, the main use of the AVA coin is to generate economic incentives. For AVA the goal is to facilitate market transactions. In the simplest form, the liquidity consumer will pay the liquidity provider in AVA. In the traditional Central Limit Order Book(CLOB), the liquidity provider is willing to execute a transaction at a fixed price, while liquidity taker will execute at the available market. The amount liquidity taker is willing to pay in AVA will affect the priority of the execution, while the overall price of liquidity will be set to attract market makers. The parallel in modern financial exchanges in the Maker-Takermodel. AVA will also be used in the more advanced AVA auction protocol to create economic incentives and create liquidity.

- A portfolio: The AVA may contain a portfolio of other cryptocurrencies and other Ethereum-based tokens. At the minimum, it will contain ETH in order to pay for gas in the blockchain transactions and as the collateral for the orders.

- An execution order with matching instruction. AVA will contain order information fields detailing the transaction. The fields will include the size of the order, leverage, the type of the order, time to expiration, amount of AVA to be used in the transaction and the optional preferred matching engine.

AVA will be the only method of settling our smart hedge contracts. It is embedded in the contract template and it the only way to create these contracts.

Smart Contract Implementation — Efuture

Two or more matching AVA orders will be combined in a smart contract that will perform transfers of ETH or other assets in the AVA portfolio according to a straightforward algorithm or a formula. External prices provided by trusted oracles or native price sources will be used as inputs. This flexibility allows to specify both simple exchanges and hedges as well as arbitrary derivatives.

The “hello world” contract in AVA protocol is Efuture — a contract that maintain the value of the AVA portfolio equal to USD 1 for a specified period of time or as long as each AVA coin in the contract contains ETH funds.

Efuture will contain

- The notional of the contract. E.g. $1mm

- An initial margin (collateral) in ETH that provides security for the contract. E.g. 10% of the notional. The margin will also determine the leverage of the position, 1:10 in this example. It will automatically serve as the stop-loss on the position as the contract terminates once the collateral is depleted.

- The collateral moves from one party to another according to a formula and one or more oracles. We start with the Dollar contract that maintains the value of in USD for the party

- At expiration, the ETH is distributed between the parties if price fluctuations were within a predefined range. If price of ETH drops more, the party A will accumulate all the collateral (ex fees), which would be below the desired value, and party B will lose all collateral.

AVA Auction protocol

AVA coin as a part of the AVA protocol will contain a definition of a market order. Using the example of Efuture contract, the auction protocol will describe how the orders to buy or sell Efutures will be handled.

Market evolve a variety of matching order protocols suitable for specific products and environments. For example, Central Limit Order Book (CLOB) is best suited for time-sensitive and liquid markets, such as stocks and financial futures. The goal is to create the best execution environment, that is to say the highest probability of matching buy and sell orders while simultaneously trying to eliminate information leakage that hurts market participants.

An auction is more suitable for less liquid conditions.Auction process is used for single events such as IPOs and art. Continuous auction addresses both lack of liquidity and the need for recurring transactions.

We believe the AVA auction protocol is the most suitable for the blockchain ecosystems because it is designed in a distributed manner, avoids the front-running problems for simple protocols given that all information on blockchainэ is public, and handles latency of the Ethereum by spreading the collection of trading orders over a number of blocks, before matching the orders on the last block. After the matching is done, the Efuture contract is created for each orders that were successfully matched, and the collection of new orders resumes. The auction process is therefore continuous.

Periodic auction fits well for the blockchain-based markets market because of block generation cycle (15 seconds in Etherium).

In the AVA auction protocol for AVA orders sellers and buyers will send an order attached to AVA coin. Once orders are collected over a specific number of blocks, e.g. 100, and the matching will occur on block 101. The matching algorithm will satisfy all orders given the price-limit constraints and in the order of preference determined by the total amount of AVA the order is willing to pay for the transaction.

Anti-Gaming Measures

To make AVA auction market place a safer place we have designed a safety feature we call a collateral reserve. It makes gaming the market place more expensive than playing by its rules.

To understands what are safety features for, consider the scenario of market participants who want to buy Ethereum. The market benefits from the bidders staying in the auction until all the bids are matched. If however a bidder realizes that the prices are not favorable, that bidder can back out of auction at the end of reservation time, when all the bids are revealed. This is a case of asymmetric knowledge, where bidder who backs out has an informational advantage over people who stay in the auction. There are other types of market misbehavior and market manipulation, such as front running, trade washing.

There could be more safety features, such as

- Minimum execution size

- Auction time duration randomization, aka speed bumps

Blind Auction Implementation

Blind auction will contain 2 periods: bidding period and matching period.

The bidding period lasts for many block cycles. It gives enough time for a client to send a hashed version of the bid/offer. During bidding period a client does not reveal prices and quantities. Hash algorithm will be used to prove clients commitment to the order represented by AVA contract. In the end of the bidding period, the matching period starts when the clients instruct AVA contract to reveal their prices and quantities. The clients will send prices and quantities unencrypted and the protocol will check that the hash value checks out and the order that is being matched corresponds to the bidding period.

Another version of the auction will have a matching oracle that will keep all the private keys for AVA contract and there will be three time frames: bidding, matching and audit. In the end of the contract no price/size information is revealed. Matching is done by oracle that has all the private keys to conduct matching and execution of the contracts.

In the end to prove that oracle has done correct job, all the information will be revealed to a protocol at which point AVA protocol can invalidate or “bust” the trade if there was any error in processing.

AVA matching logic

The order flow chain starts with AVA contract order. AVA is assigned with the committed hash.

- Side: buy or sell

- Amount of AVA

- Indicative price

- Stop-loss price for the Efuture contact

- Size: amount of Efuture contracts

Each 100 blocks AVA protocol collects all the outstanding commitment hashes for each AVA contract order. Each AVA contract is not active until the contract is loaded with AVA coins. Once the matching timer expires, all of the activated AVA contracts are fed into matching algorithm. The matching algorithm looks for crosses in indicative price.

For all crosses it creates another matching contract with exchanged Efuture and Ethereum.

Features of a good market

In the Art of Designing Market, Alber Ross, an engineer turned Nobel Prize winning economist identified three features of a good market:

- Thickness, “that is, to bring together a large enough proportion of potential buyers and sellers to produce satisfactory outcomes for both sides of a transaction.” In financial jargon thickness is liquidity. Lack of liquidity is the main problem that AVA protocol is designed to solve and is the point of failure of many unsuccessful attempt to introduce derivatives in Ether.

- Safety. “They need to make it safe for those who have been brought together to reveal or act on confidential information they may hold. When a good market outcome depends on such disclosure, as it often does, the market must offer participants incentives to reveal some of what they know.” Transparency is embedded in public blockchain protocol, and is intrinsically valuable. AVA embraces transparency of Ethereum, and is not attempting to solve the “non problem” of secrecy. In fact, we welcome development of alternative contracts, matching engines and oracles as larger opportunity set and volume is exactly where the value of AVA is coming from. AVA, however, easily allows confidential negotiations such as “blind” auctions where the bids are submitted as hashes, so that the actual bids are not revealed in advance of the auction.

- No Congestion. “They need to overcome the congestion that thickness can bring, by giving market participants enough time — or the means to conduct transactions fast enough — to make satisfactory choices when faced with a variety of alternatives.” This is a very important objective easily misunderstood. Speed is not a goal in itself and in fact can often be of dubious value, for example, in the race to the bottom in high frequency trading. Congestion is a “good problem” to have in nascent illiquid markets. However it is an issue given poor synchronization between the blockchain and the outside world and the large latencies. A careful design and a marketplace for the oracles is the key aspect to address the congestion problem. The incorporation of frequent-auction matching engines in the protocol mitigates this potential problem.

Future of AVA protocol

Our long term vision exceeds merely maintaining a stable coin or hedging, but rather provides the ability to short various cryptocurrencies. Short selling is selling security that you do not own. To short sell, security must be borrowed and then sold. To liquidate short position, one must buy it back and return to the borrower. Short selling is prompted by a bearish view on a market for a particular security, in our case a belief that a cryptocurrency will drop in value.

Shorting appears as a predatory activity, but like predators in the natural ecosystem, short selling serves a vital role to quickly liquidate or suppress cryptocurrencies that are malicious, badly designed and destined to fail.

AVA protocol easily translates to indices other than the USD. The only step would be to clone the existing setup and substitute the USD/ETH oracle for anther external oracle. Another advantage would be the ability to hedge to the price of gold or the EUR, currently an impossible task with more rigid fiat-based stable coins. Future endeavors include portfolio tracking equity indices and other more complicated derivative products.

Implementation.

Proof of concept working prototype for AVA auction mechanism including multiple bids, the auction and generation of smart contracts has been implemented on test net in Solidity. The code exists on github. For the access please contact us (see below).

How to contact the AVA team.

Please feel free to contact me, Arturas Vaitaitis, co-founder of AVA, New Jersey at AVACoin19@gmail.com

Comments

Post a Comment